Lecture 7.1

Washington Consensus Reforms

Emmanuel Teitelbaum

The Washington Consensus

10 Policy Prescriptions

- Fiscal discipline

- Public expenditure (investment vs consumption)

- Tax reform (expand tax base, cut marginal rates)

- Financial liberalization

- Competitive exchange rates

- Trade liberalization

- Foreign direct investment (remove barriers)

- Privatization of state-owned enterprises

- Deregulation of markets

- Secure property rights

Economic Crisis

Elements of an Economic Crisis

- Recession

- Low or negative growth rates

- High unemployment

- Hyperinflation & shortages

- Government prints money to cover debts

- Hoarding

- Balance of payments crisis

- Sudden stops or reversals of capital inflows

- Debt crisis

- Proliferation of public debt relative to GDP

- Financial crisis

- Assets bubbles

Causes of Crisis (Neoliberal Diagnosis)

- “Bloated” public sector

- Inefficient/wasteful

- Crowds out private sector investment

- Corruption

- Deters investment generally

- Over-regulation of private sector

- Impedes expansion of formal sector

- Government spending and debt

- Drives inflation

Crisis in Eastern Europe

Economic Organization Under Communism

- Centralized planning

- Bureaucratically established quotas and targets

- No market dynamics of supply and demand

- Key economic goals

- Full employment

- State ownership and control

- International isolation/autarchy

Pitfalls of Central Planning

- Information

- No price mechanisms

- Government is not omniscient

- No way to regulate supply and demand

- Barter economy, black markets and shortages

- Perverse incentives

- No profit-maximizing behavior

- Lack of innovation

- Soft budget constraints in public sector: waste, theft, poor quality of goods

Adverse Results

- Widespread theft and embezzlement of state property

- Centralized planning system stops working

- Escalating inflation because counties keep printing money

- Mass shortages of even basic goods

Crisis in India

India’s Economic System

- “Nehruvian” industrial policy rather than central planning

- Import substitution

- Protection of domestic industry

- High tariffs

- Market controls

- ‘License-Quota Raj’

- Dominance of the public sector

- Low quality goods

- Shortages

- Inefficiency

- End result: inflation and decreased trade

1991 Economic Crisis

- Proximate cause: balance of payments (BOP) crisis

- Occurs when the total amount of receipts is less than the amount of total payments

- Causes of crisis in India

- Collapse of Soviet Union (Trade)

- Gulf War (Oil)

- Capital flight, speculative attack on credit, balance of payments and currency crisis

Neoliberal Reforms

Reform #1: Stabilization

- Goal: prevent hyperinflation from escalating out of control

- Austerity regime meant to curb inflation

- Reduce or halt public spending

- Curb public expectations

- Devalue currency

- Raise taxes and government revenue

- Can’t print money to solve the problem

Reform #2: Liberalization

- End price controls, production quotas, reservations, etc.

- Encourage foreign trade and investment

- Reduce tariff barriers

- Lift curbs on foreign direct investment

- Goals

- Attract real money, which is in short supply

- Increase competition and innovation

- Spur investment in industry and high-end services

- Reduce state subsidies (expensive, interfere with market forces)

- Cash, tax breaks, loan guarantees, procurement prices, stock purchases

- Farm, oil, housing, export, etc.

- Financial sector reforms

- Allow private and foreign banks freedom to operate

Reform #3: Privatization

- Selling off of state assets to private actors

- Develop greater efficiency and increase output

- Better managers

- Better incentives

- Create markets and entrepreneurs

- Generate revenue for the state

Reform #4: Structural Adjustment

- Long-term structural reform

- Extending neoliberal reforms

- Reducing government role in economy

- Liberalizing factor markets

- Land, labor, capital

- The ultimate goal is to boost productivity

- Not just removing price controls or privatizing

- Making institutions growth-enhancing

- Industrial policy, investment policy, governance, etc.

Shock Therapy vs. Gradualism

“Shock Therapy”

- Quick moves to stabilize the economy through an evolutionary approach

- Goal of remaking economies quickly

- Internationally-renowned teams experts sent to oversee reforms

- Eastern Europe is a good example

Gradualism

- Step-by-step implementation of reforms

- Put correct political institutions in place before revamping the economy

- Courts, tax inspectors, regulatory agencies, and financial intermediaries

- Advocated by other prominent economists (Joseph Stiglitz) and intellectuals

- India is a good example

- Fast on trade, investment and license quota raj

- Slow on privatization, labor law and other contentious reforms

“Partial Reform Equilibrium”

- Winners of early reforms blocked further progress:

- Benefited from access to legislation and coveted assets

- Created a system in between capitalism and communism where a select few benefitted

- State Capture

- Powerful private interests asset control over both the economy and political decisions

- Think oligarchs!

Businesses Corrupting the State

- Innovative ways of wielding influence

- Buying laws outright

- Running for elected office

- Hiring the relatives of politicians

- Mobilizing their workers to act politically

Effectiveness of Reforms

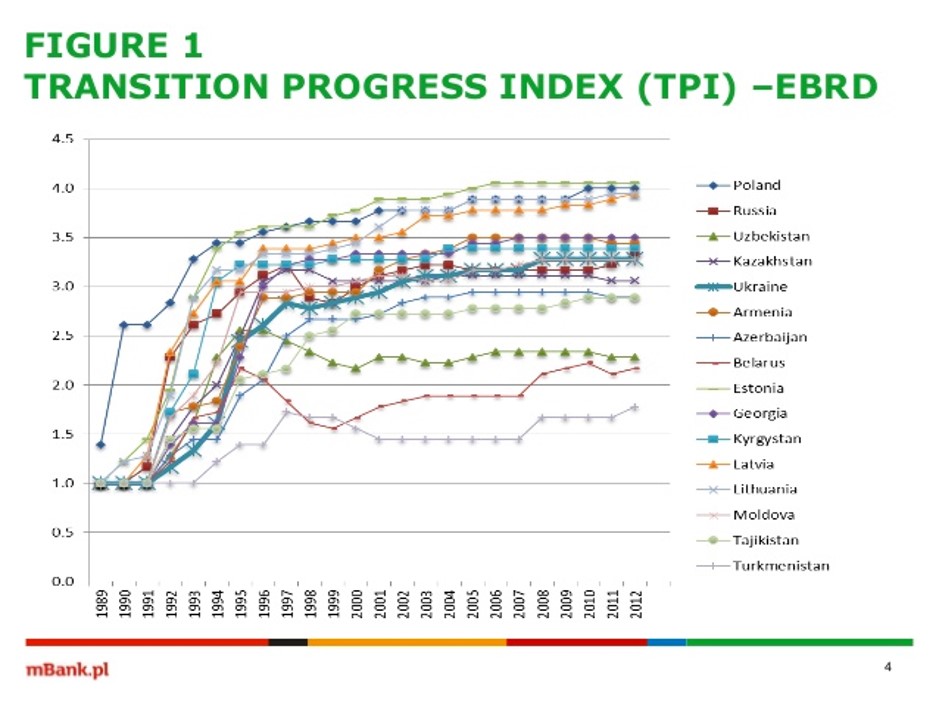

Transition Progress in Eastern Europe

EBRD TPI

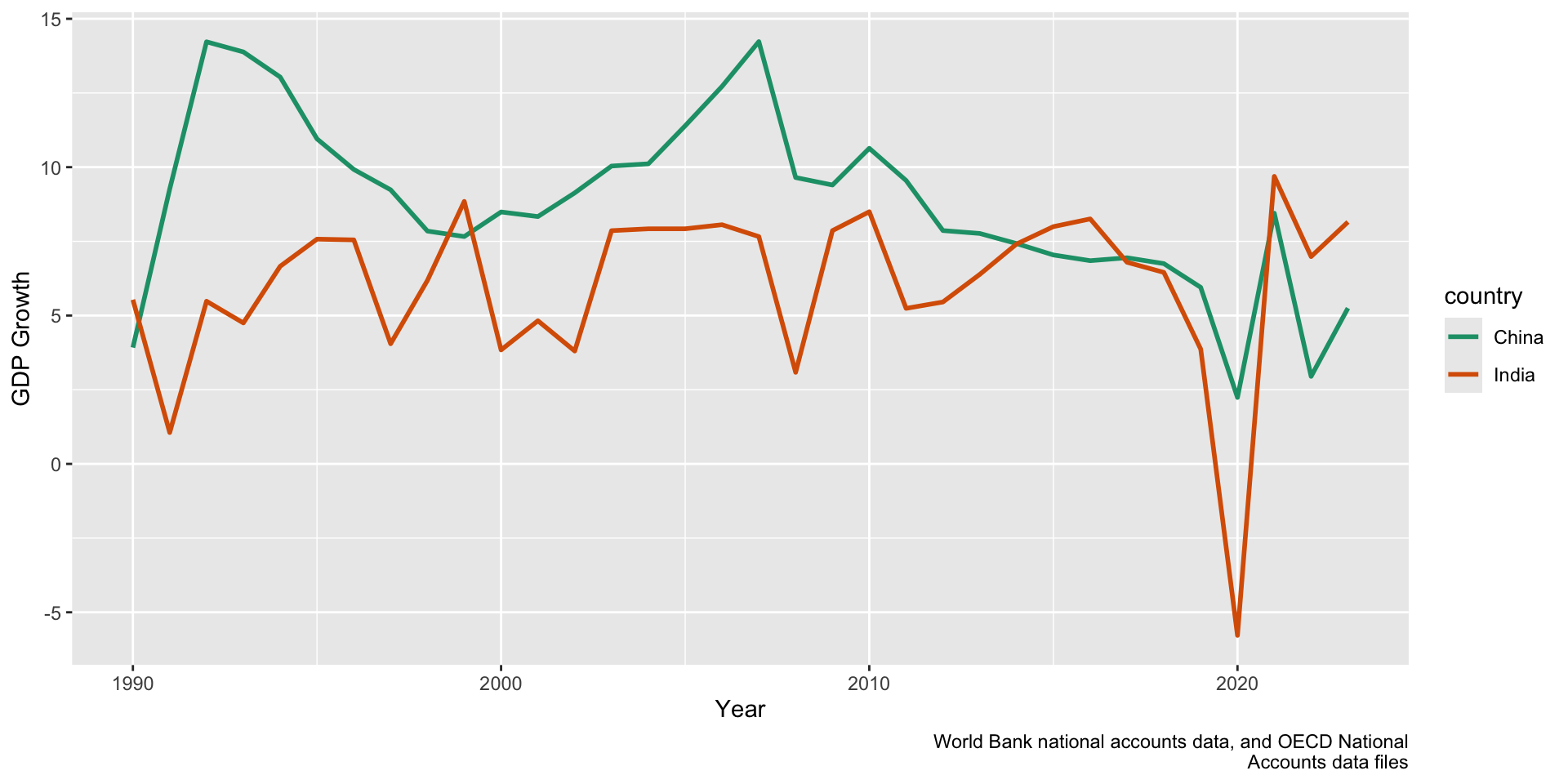

Growth Rates in India and China

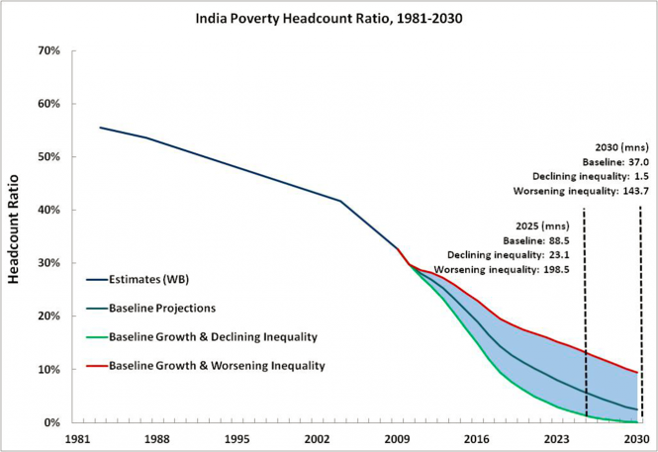

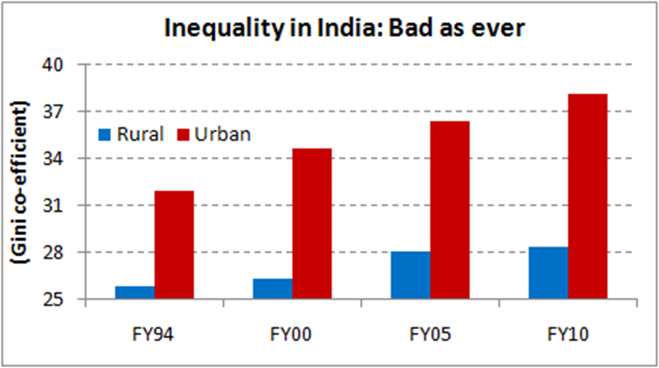

Poverty and Inequality in India

Archibong et. al.

- What is the main hypothesis?

- What reforms are they examining in the African context?

- Quantitative analysis

- What are they trying to show?

- Is it convincing

- Case studies, each group take one

Contemporary Reform Initiatives

Sri Lanka

- Swimming in the president’s pool

- Causes of the crisis

- Years of economic mismanagement under Rajapaksas

- Rajapaksa govt. cut taxes after it came to power in 2019

- Banned fertilizer which decimated rice crop (staple)

- COVID-19 killed demand for tourism and remittances

- Then war in Ukraine led to grain shortages

- Sri Lanka ran out of money couldn’t by fuel or medicine

Discussion

Lebanon

- When robbing a bank seems perfectly justified

- Read about the World Bank’s assistance to Lebanon

- How is the Bank’s strategy similar to or different from the original Washington Consensus Policies?